How it works?

No-cost EMI on Melorra allows you to break down the expenses for your purchase into equally divided monthly installments of a tenure of your choosing at 0% interest

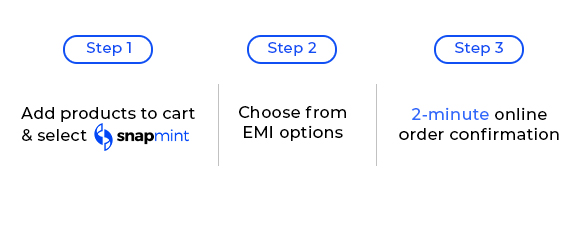

Step 1

Select your favourite fine jewellery.

Step 2

Choose your EMI option at the checkout.

Step 3

Enter your details and complete the order.

Step 4

We will take 24 hours to verify your documents and confirm your order.

EMI Calculator

Melorra EMI for Diamond and Gemstone

Melorra has partnered with Snapmint to offer an EMI facility for customers shopping exclusively for Diamond and Gemstone jewellery. Snapmint is an online portal that makes Equated Monthly Installments (EMI) for customers easy. Snapmint is registered with the Reserve Bank of India (RBI) and follows the respective guidelines.

Snapmint EMI Benefits for Melorra Online Customers

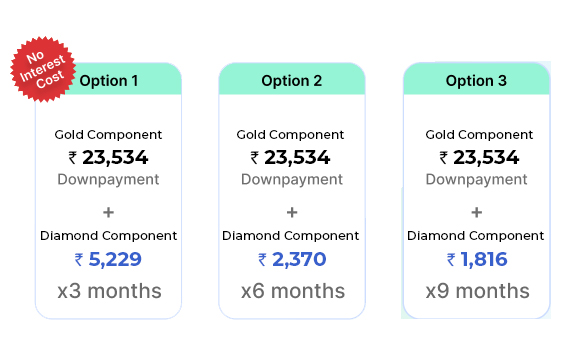

Snapmint EMI option at Melorra applies only on Diamond and Gemstone jewellery (EMI on NON-GOLD components only). Here are the Snapmint EMI benefits:

Hassle-free online process - it's paperless!

No Interest cost applied

No hidden charges!

Credit Card not required

Offering 3, 6, and 9-month EMI plan

Step-by-step Snapmint EMI Process

Snapmint EMI Options

Snapmint EMI Eligibility for Offline Store Purchase:

Price Range: 1Lakh - 2Lakh (approx.)

- Employment Type: Salaried or self-employed

- Income Tax Returns (ITR) detail is mandatory

- The credit scores should be more than 750

- Customers should have 6 months' bank statement/ GST returns

- EMI amount 20% of salary (active non-revolving credit card) or EMI greater than the customer’s Average Quarterly Balance AQB/2 from the bank statement with 5x of EMI worth credits every month

- Credit statements should not have any defaults

Price Range: Above 2 lakh

- Customers should be Employed (non-Salaried will not be considered)

- Income Tax Returns (ITR) detail is mandatory

- 6 months’ bank statement is required for the Snapmint EMI process

- Provident fund verification is mandatory for the Snapmint EMI process

- Snapmint EMI amount should be 20% of the salary

- No defaults in credit history should be carried

- The credit scores should be more than 750

- No existing EMIs to be carried more than 35% of their salary

- EMI should be lesser than the Ten-day median in the bank statement

- EMI should be lesser than the Average Quarterly Balance(AQB) /2 in the bank statement

*T&C Applied